Unlocking the Power of Time: Why the ‘Rule of 72’ Is Trending in Today’s Financial Climate

Introduction

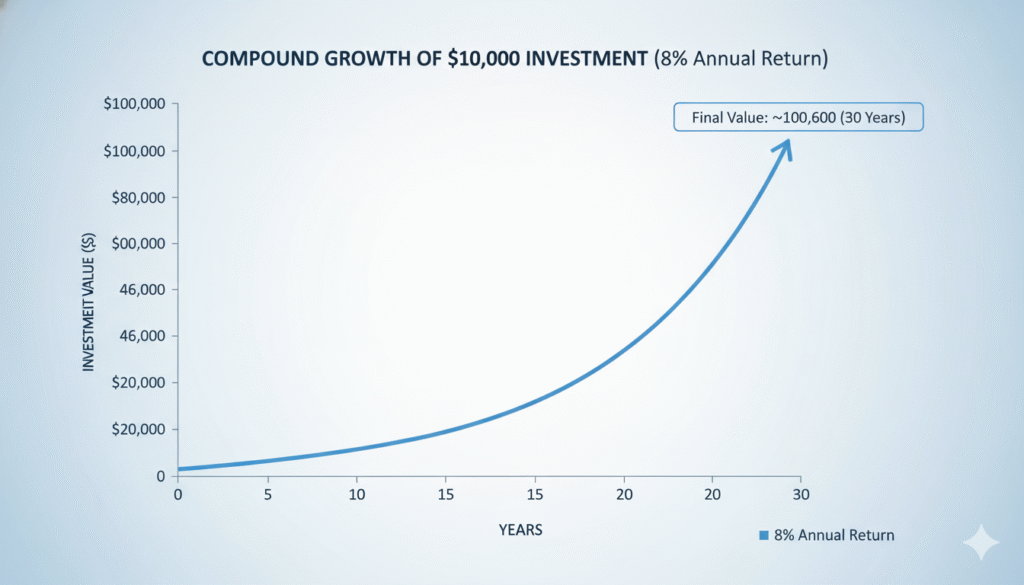

In the world of personal finance, one concept reigns supreme: compound interest. Often called the “eighth wonder of the world,” compounding is the process of earning returns on previous returns, essentially causing your wealth to grow exponentially. However, accurately calculating this growth over time can be complex. Enter the Rule of 72, a straightforward mathematical shortcut that is resurfacing in financial trends as investors and planners look for simple tools to navigate inflation and market volatility. This rule provides a quick, reliable estimate of how long it will take for an investment to double in value.

Context and Relevance of the Rule of 72

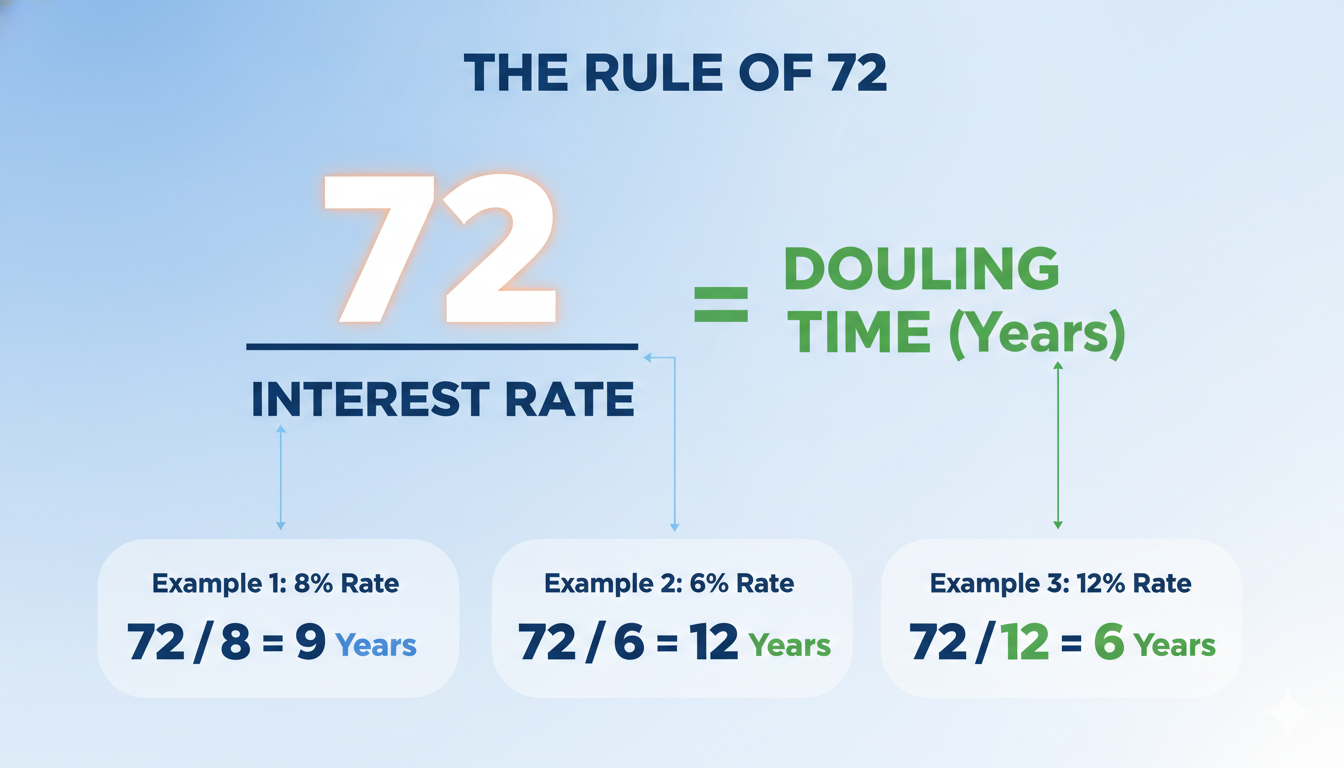

The Rule of 72 is an indispensable tool for anyone starting their investment journey or those reviewing their long-term financial strategy. It states that to estimate the number of years it will take for your investment to double, you simply divide 72 by the annual rate of return (interest rate).

$$\text{Years to Double} \approx \frac{72}{\text{Annual Interest Rate}}$$

For example, if you find an investment yielding a consistent 8% annual return, the calculation is simple: $72 \div 8 = 9$. This means your money is projected to double in approximately 9 years. Its relevance today stems from its simplicity in highlighting the opportunity cost of low-return investments and the massive long-term advantage of starting to invest early, proving that time is often a greater ally than large lump-sum investments.

Recent Data and Key Facts in Focus

While the Rule of 72 is an approximation—best used for interest rates between 6% and 10%—its renewed focus is driven by current economic anxieties:

- Inflation Impact: Recent news headlines discussing reduced inflation forecasts and fluctuating interest rates (as seen in global economic projections) make the Rule of 72 critical. It helps investors quickly gauge if their investment’s return rate is fast enough to outpace the real-world loss of purchasing power due to inflation.

- Alternative Rules: Financial educators on platforms like YouTube are often discussing the Rule of 108 and Rule of 132 (for tripling and quadrupling your money, respectively) to show the accelerated power of long-term compounding. This signals a public desire for more sophisticated, yet accessible, long-term financial planning tools.

- Security and Fraud: Concurrently, while people focus on growth, recent financial news has highlighted new banking security measures, such as the option for banks to temporarily block transfers for 72 hours in case of suspected fraud. This emphasizes that growth must be pursued alongside robust financial safety.

Societal and Personal Impact

The greatest impact of the Rule of 72 is psychological and behavioral. By visualizing the doubling time of their wealth, individuals:

- Gain Motivation: Seeing their principal double in a predictable timeframe motivates consistent saving and investing habits.

- Make Better Comparisons: The rule allows for quick, “back-of-the-envelope” comparisons between different investment vehicles (e.g., comparing a guaranteed 5% CD vs. a potentially riskier 10% stock portfolio).

- Encourage Early Start: It powerfully illustrates how waiting even a few years can significantly delay the compounding effect, proving that the best time to start investing was yesterday.

Reflections and Future Trends

The simple math of the Rule of 72 will remain timeless, especially as Artificial Intelligence (AI) takes over more complex financial management tasks. Future trends will likely see AI-powered financial apps using the Rule of 72 to generate personalized, easy-to-digest projections, automatically adjusting the doubling time based on real-time market returns and inflation data. The trend is clear: demystifying complex financial concepts to empower everyday consumers.

Conclusion

The Rule of 72 is more than a formula; it is a fundamental principle of wealth creation. By giving you a simple way to estimate the growth of your investments, it transforms the abstract concept of compound interest into a tangible projection. Mastering this simple piece of mathematics is a crucial step toward taking control of your financial future and visualizing the extraordinary power of time on your money.

Further Reading Invitation: Explore our other articles on essential investing concepts and managing personal finance in a volatile economy.